What is Commercial Debt?

Commercial debt collection refers to the process of business-to-business debt collection, recovering debts owed by one business to another, such as unpaid invoices or missed repayments. Recovering commercial debt can be a complex process that involves identifyingthe parties involved, determining the terms of the debt, and using legal or other means to collect payment.

There are a few ways for businesses to handle their commercial debt collection. One way is to handle the process in-house, using internal staff or the billing department to handle the invoicing and collections efforts. This team can focus on communicating with debtors and is a good option for small businesses with a limited number of outstanding debts. However, larger businesses may find that they lack the resources to devote to debt collection, or that they simply lack the expertise necessary to collect debts efficiently.

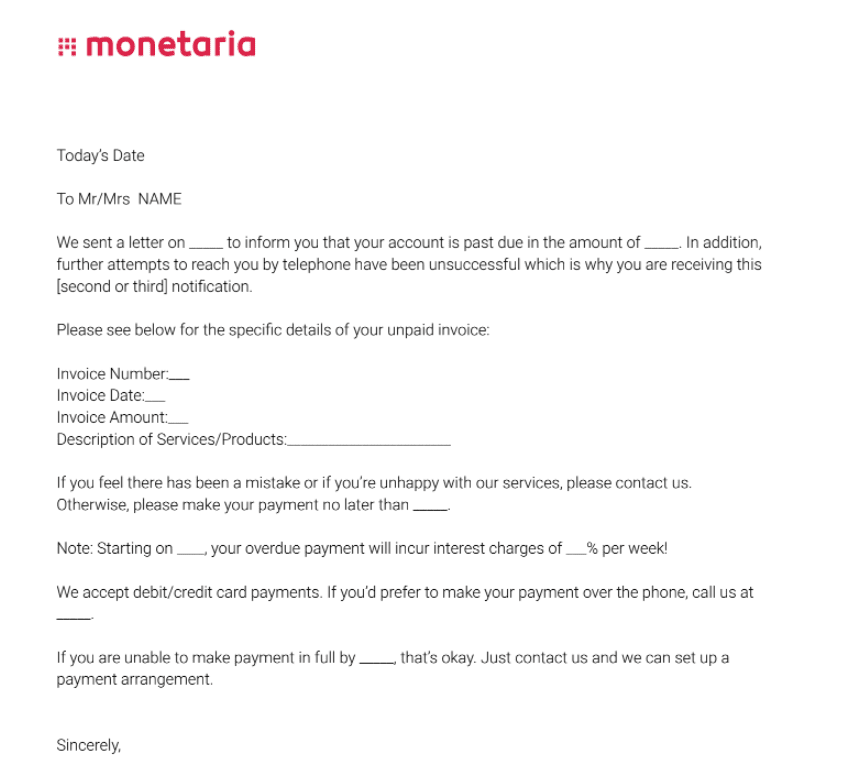

In such cases, businesses may choose to hire a third-party debt collection agency. These companies specialize in recovering unpaid invoices and receivables, and can often do so more efficiently and effectively than businesses can on their own, and free up the business owners’ time to chase new business instead of over-investing in delinquent clients. Debt recovery and collection agencies use a variety of tactics, such as negotiating payment plans and exploring legal options to try to collect the debt.

Commercial debt recovery may involve legal action, such as filing a lawsuit, obtaining a judgment, and garnishing wages or seizing assets to recover the debt. Legal action should be a last resort, as it can be costly and time-consuming, but may be necessary if other efforts have failed.

It is important for businesses to have a clear and effective process in place for recovering unpaid debts. This can help ensure that the company maintains cash flow and avoids financial hardship, and helps protect the company’s relationships with its own customers or suppliers.

Regulation of Commercial Debt Collection

Commercial collection services are regulated by a number of federal and state laws. These laws outline the rights and responsibilities of both the creditor (the business trying to collect the debt) and the debtor (the business that owes the debt).

At the federal level, the Fair Debt Collection Practices Act (FDCPA) sets out rules for how consumer debt collectors can interact with debtors. While the FDCPA applies to personal, family, and household debts, and not to debts incurred by businesses, many states have their own debt collection laws that apply to commercial debts, and these laws may provide additional protections for debtors.

In addition to these laws, there are also industry-specific regulations that may apply to commercial debt recovery and collection. For example, the healthcare industry is subject to the Health Insurance Portability and Accountability Act (HIPAA), which has provisions related to the collection of medical debts.

Collection agencies must be licensed and bonded before performing collections in most states, so it is critical to ensure that a third-party agency is qualified and credentialed for commercial debt collections before hiring them. The Monetaria Group is led by a team of debt collection attorneys who ensure that all debts and cases are being handled legally and competently, with no chance of trouble down the road.

Is Commercial Debt Collection the Right Choice for My Business?

When deciding whether to hire a commercial debt collection agency, businesses should consider factors such as the number of outstanding debts, the resources available for debt collection, and the expertise necessary to collect business debts efficiently. A larger number of outstanding debts or a lack of resources or expertise may make it more efficient to use a third-party agency.

However, businesses should be aware that using a collection agency may be expensive, and it’s important to carefully consider the costs and benefits before deciding whether to use one.

Commercial debt collection is a critical aspect of managing a business’s financial health. By having a clear process in place and working with experienced professionals, businesses can effectively recover unpaid debts and maintain a healthy bottom line.

We’re happy you found this article informative! Go back to our blog page to find more tips, tricks and guidance on collections, to ensure your business gets paid.

If you have unpaid debts that need to be recovered, commercial debt collection may be a good option for your business. A commercial debt collection agency can help you with the process of recovering past-due accounts and provide guidance on best practices for managing accounts receivable.

Led by a team of experienced commercial debt collection attorneys, Monetaria has helped hundreds of businesses recover and collect their outstanding debts and payments. Schedule a FREE consultation with our expert team to see how we can help you recover your money today!